As a homeowner, the tax season brings both opportunities and responsibilities. Understanding the tax implications of homeownership and taking proactive steps to prepare can help you maximize deductions, minimize tax liabilities, and ensure a smooth filing process.

Although tax season is not the most exciting, we want you to move forward with confidence and ease, so let’s explore some of our essential tips and strategies.

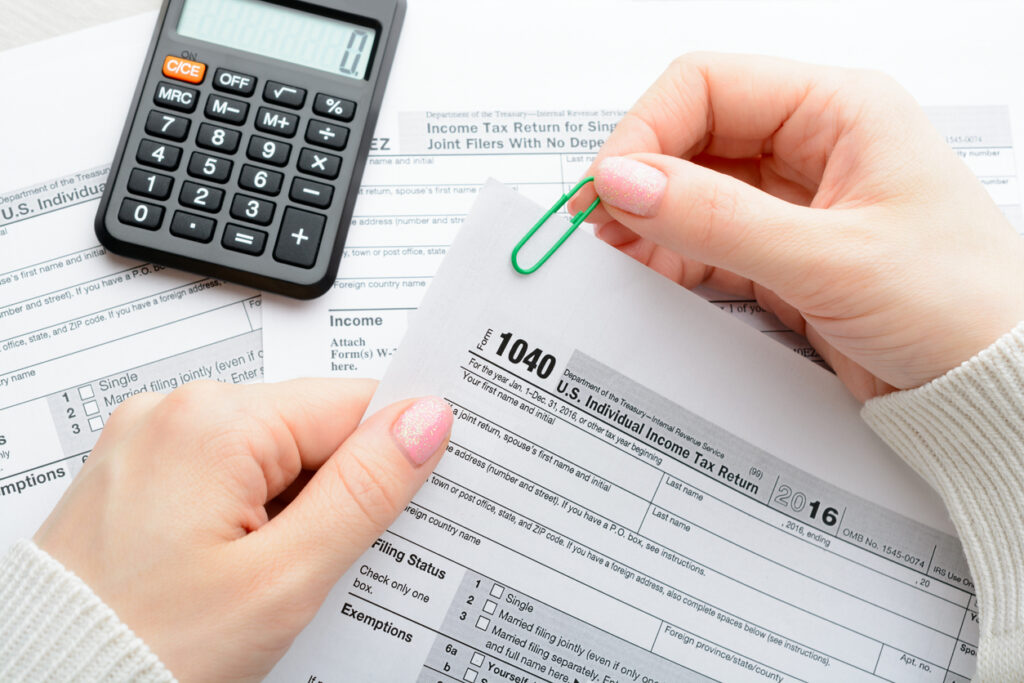

Gather Important Documents

Start by gathering all relevant documents related to your homeownership, including:

- Mortgage interest statements (Form 1098)

- Property tax statements

- Home improvement receipts

- Energy efficiency upgrades documentation

- Records of any home office expenses (if applicable)

- Closing documents for any refinances or home sales

Organizing your documents early will streamline the tax preparation process and ensure you have everything you need to report your homeownership expenses accurately.

Understand Tax Deductions and Credits

Familiarize yourself with the tax deductions and credits available to homeowners in such as:

- Mortgage interest deduction: If you itemize your deductions, you can deduct the interest paid on your mortgage loan up to a certain limit.

- Property tax deduction: Idaho allows homeowners to deduct property taxes paid on their primary residence.

- Energy-efficient home improvements: Certain energy-efficient upgrades, such as solar panels or energy-efficient windows, may qualify for federal tax credits.

Understanding these deductions and credits allows you to take full advantage of available tax benefits and potentially lower your tax bill.

Consider Home Office Deductions

If you use part of your home regularly and exclusively for business purposes, you may be eligible to deduct home office expenses. To qualify, the space must be your primary place of business or used regularly for meeting clients or customers. Keep detailed records of expenses related to your home office, such as utilities, insurance, and maintenance costs, to support your deduction claims.

If you are a freelancer, have a side hustle, or run your own business in addition to your W-2 job, you may be able to take the home office deduction. The office or space where you conduct this separate self-employed business can’t be the same space where you also work as an employee. This line can get blurry very quickly, and there are other details to know. Make sure you’re staying on the right side of the rules if you plan to claim this tax break.

Additional Considerations for Home Office Deductions

It’s crucial to understand other rules and considerations that may impact your tax situation when claiming home office deductions.

Receipts and Documentation

If you intend to deduct actual expenses for your home office, it’s essential to maintain detailed records of all business-related expenses. This includes retaining receipts for equipment purchases, utility bills, electric bills, repairs, and any other expenses you plan to deduct. Thorough documentation will help substantiate your deduction claims and ensure compliance with tax regulations in the event of an IRS audit.

Home Sales Implications

Homeowners who claim the home office deduction using the actual expenses method should know the potential impact on capital gains taxes when selling their home. Under IRS Publication 523, individuals who sell their primary residence after residing in it for at least two of the past five years may be eligible to exclude up to $250,000 in profit from the sale ($500,000 for married couples filing jointly). However, claiming home office deductions based on actual expenses could potentially reduce or eliminate this exclusion, resulting in capital gains tax liabilities.

Depreciation Considerations

If you opt for the actual expenses method for home office deductions, you are required to depreciate the value of your home. Depreciation is an income tax deduction allowing taxpayers to recover property costs due to wear and tear, deterioration, or obsolescence, according to IRS guidelines. When you sell your home, any depreciation claimed for home office use may be subject to capital gains tax.

For example, if you use 20% of your home as a home office and claim depreciation, 20% of the profit from the home’s sale could be subject to capital gains tax. Alternatively, utilizing the simplified method for home office deductions eliminates the depreciation factor, potentially reducing or eliminating capital gains tax liabilities.

Review Capital Gains Exclusions

If you sold your primary residence during the tax year, familiarize yourself with the capital gains exclusion for homeowners. Under current tax laws, individuals can exclude up to $250,000 in capital gains ($500,000 for married couples filing jointly) from the sale of their primary residence if certain criteria are met. To qualify, you must have owned and lived in the home as your primary residence for at least two out of the past five years.

Consult with a Tax Professional

Navigating the tax implications of homeownership can be complex, especially if you have unique circumstances. Seeking guidance from a qualified tax professional will not only provide personalized advice but could also identify other potential tax-saving opportunities.

As a homeowner, preparing for the 2024 tax season requires careful planning and attention to detail. By gathering important documents, understanding available deductions and credits, considering home office deductions, reviewing capital gains exclusions, and consulting with a tax professional, you can confidently navigate the tax filing process and maximize your tax benefits as a homeowner. With proactive preparation, you can make tax season a seamless and rewarding experience while reaping the financial rewards of homeownership!